I recently attended a parent workshop at my toddler’s school, ‘How much is too much – help your child by understanding how to manage screen time and create healthy boundaries with digital devices and content.’

One of the key factors, explained the expert facilitator, was to start early! When the child is young, it is easier for parents to set boundaries, say ‘no’ and offer alternate modes of engagement; make agreements, wean away and train on better habits, than when the child grows into the pre-teens and teens.

Isn’t it the same when it comes to understanding finances? I could draw so many parallels between Ms Fathima Khader’s workshop around gadget management to wealth management for kids.

Most of us had that hundi/ gullak (piggy bank) while growing up where coins given by our relatives were lovingly saved. That clink! clink! of dropping coins into our hundi put us in the most ecstatic state. Such a simple pleasure of life – to have money to spend at the street corner tuck shop.

The generation of little emperors today might need many dozen piggy banks to fund their branded demands for toys, gadgets, video games, birthday treats, social activities and for whatever their peers show off to them. They also seem to be born with a 9th sense (according to my 75 year old spiritual guide, this is a reality) and absorb all types of learning superfast!

Isn’t it then an essential life-skill, to equip ourselves with workshops like ‘How soon is too soon – help your child by understanding how to manage their finances and create healthy agreements over spending and saving.’

Remember Money is a powerful energy, a lot of energy! It is not simply a piece of paper or gold. No one crushes it and throws it somewhere. This piece of paper carries with it tremendous power as something that is alive and can do things!(https://yourlifeandmoney.com/yes-you-can-be-rich/)

Our children should be able to learn and understand this as early as possible in life, to use wealth as a means to an end and not to let it shroud life and living itself!

Conscious way to build your child’s healthy relationship with wealth

Think about

1. How you, as parents relate to money – thrifty, spend thrift, emotional spenders, hoarders, investors.

2. How does money work in your home? Is it a tool used to display your affluence to friends; is there a balance between saving and spending; does everyone get equally served by money; do you take care of senior members’ needs with your money; do you share money via philanthropy and such questions.

Life & Money in collaboration with The Garrett Planning Network in the U.S.A will enable parents to plan for their children’s education and life’s milestones though their Women Financial Advisers Network in India, being launched shortly.

Through this holistic approach, the Advisers will offer fee-only financial life planning and investment advisory services to their clients. This will also enable their clients and the clients’ families to lead a ‘healthy, wealthy, happy and meaningful life.’ To know more, please see our brochure

As parents, what could you immediately adopt to help your children build a healthy relationship with wealth:

-

Avoid using money and gifts as rewards/ punishments.

-

Have a clear transparent way how money is spent and on what activities and why. Having agreements on when money will be spent on clear milestones is a good method to adopt too!

-

Avoid giving money just to fix boredom, distract or calm down children or keep them out of your way or because he or she is an ‘only child.’

-

Hold limits in a kind, supportive way – Saying No makes you a confident parent and not a mean one.

-

For birthdays and special occasions, try to offer non-monetary experiences instead. The child will understand that enjoyment and family experience is not limited to money, it’s a lot more enriching than that.

-

Help them plan how to spend:save their piggy bank money and see it grow!

When children earn their money through vacation jobs for example, they realize the power and satisfaction of earning and suitably deploying their wealth. When they use the money to invest into suitable plans advised for them or fuel their choice of extra curricular classes or a fun activity, it makes them feel independent, ‘able’ and worthy.

As parents, it is also important to be convinced and serious, consistent about the method and its practice. You are their role model for a good 7-10 years that lays the foundation for their life and money scripts for their lifetime! It will help them to make better and informed choices in all aspects of their lives including managing wealth well. If you are too rigid or lax, the lesson might not be taken seriously, defeating the very purpose of the child’s money management.

-

Allow them to ask questions, be curious and explore for information rather than being lazy about money and taking you for granted.

-

Let them make mistakes too! Sometimes their financial decisions are bound to go wrong. Use it as a learning experience.

-

Let them teach you if they have learnt to do something differently and succeed at it!

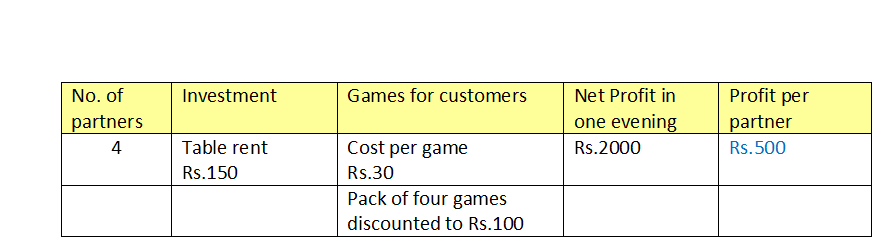

During a Diwali (festival of lights) fete at our housing society few months ago, stalls were being offered to residents to put up exhibits and articles for sale ranging across clothes, food, bags, décor items, Diwali lamps etc. A group of 4 teens, oldest being 13 years, put up a table and chair and offered 4 games to anyone who would want to try.

The games itself were not purchased and involved some paper cups, a ball, a pen and such items brought from their homes. While one partner managed the stall, the others enterprisingly approached people who entered the hall and convinced them to try the combined offer. They also motivated the hesitant ones like me saying, “You can easily do it. We will help you. Please try” and the prize for winners was chocolates, again brought from home.

In the first hour they made Rs.400 and one teen even used his share of the money immediately to buy his mother a pair of trinkets, telling her proudly ‘Ma, I bought this for you from my first earning.’ Needless to say, the mother was showing off the earrings to all her friends that evening.

Our children can definitely teach us a trick or two on enterprise and business if we allow them!

Credit:

Fathima Khader ‘How much is too much’ – help your child by understanding how to manage screen time and create healthy boundaries with digital devices and content (https://www.facebook.com/pg/TheEvolveED/about/?ref=page_internal)

Cover Photo Credit – Jack Ward, Unsplash

Piggy bank image – Photo by rawpixel on Unsplash

Father and son shoes image – Photo by Markus Spiske on Unsplash

0 Comments