The following blog is by Amy Jo Lauber originally published on her blog page.

How do you live today and how much does it cost?

What elements of this life do you embrace with joy and what elements cause you worry, grief or anxiety?

I’m guessing, for many of you, this is the first time you’ve been asked those questions or that you realized there were categories in your spending that you could nurture for your own well-being and others you could limit, control or otherwise navigate.

As I worked for many years in the financial services industry, my colleagues were (and still are) primarily focused on helping clients save for retirement. They’d all use the heuristic (which means “mental shortcut”) that you’d need about 80% of your pre-retirement income to meet your retirement living expenses and plan off of that assumption.

When I started to probe about the client’s living expenses today, many of my colleagues would bristle, not wanting to make our clients work. Instead, they just wanted to use a figure suggested to the client, such as $100,000 per year. (I assume most clients were too embarrassed, overwhelmed, or confused to correct the adviser.)

But how can we plan for 80% of what we don’t know we spend, need, desire, or brings us fulfillment?

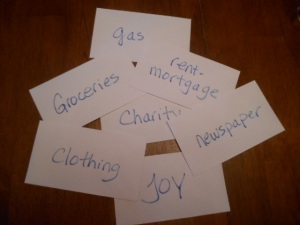

If you follow the envelope system, is there an envelope for “Joy?”

Now that I have the freedom offered in my private practice, I explain to each client thatthe most important part of their financial plan is their living expenses today, because all other planning projections (including how much they need to save for retirement, what is needed for each person in the event of a disability, if there is enough resources for each survivor in the event of a death, and what could be budgeted for education, debt repayment, vacations etc.) depend on how they live right now and what they’d like to change to make it a life of meaning and fulfillment.

Tracking (and ultimately intentionally directing) these numbers is a bit of like playing detective and it’s crucial to find a method that works for you.

Cue my “I HATE Budgeting (But I Like Having Money)” support group. We’ve been meeting for three and a half years now, talking about how difficult and important budgeting is. (If you’d like to read the revelations, tips, ideas, strategies and other insights shared within group, check out the “Budgeting” category on my blog. You’re seriously not alone. Not by a long shot.)

Living a life of intention and in accordance with your values and priorities isfreeing and energizing…but it can be challenging.

All of those Facebook posts we “like” about living the life of your dreams, not caring what people think, and choosing your own path are all well and good until you choose to actually live that way.

We humans are social creatures; we want to belong.

Doing things differently threatens our place in the group.

That’s perhaps why Facebook and Twitter have become such significant pieces of our daily lives: They help us connect with our tribe; not the one we’re born into or live near. We can gain support and positive feedback from people who “get it” (and more importantly getus) and are on the same path.

This is powerful. This is why I created my support group.

My husband and I are pretty frugal. (Do you know the difference between “frugal” and “cheap?” The former is with intention and the latter is with fear.) Because of these tendencies, some people may judge or question our choices, but this lifestyle allows for amazing opportunities, like going to India and Disney World.

There is a blog I suggest you follow called Mr. Money Mustache. One of my budget group regulars (jazz singer Mari McNeil who has a pretty awesome blog about living really well and with intention) suggested it to me and I’m so glad because I love what this guy writes. I share this excerpt from an interview with Pete, its founder, from MarketWatch.com.

“… if you understand the fundamentals of what it means to be a happy person, you realize that buying more stuff for yourself has no relationship at all to how happy you are.

These fundamentals include things like close relationships with other people, health, rewarding work, a chance to be creative and help others.

Work on those things and you’ll start living a much better life immediately, and soon wonder where the odd compulsion to own a yacht with a submarine came from in your old self.”

Here is the entire article. If you want to really get serious about retirement (however you define what that means and what it will look like and when), you need to get serious about living today and choosing to live, earn, save, spend, invest, protect and sharewith complete intention.

“Freedom” by Zenos Frudakis

*Freedom Freebie*

If you’d like a copy of a budget worksheet to help you determine your expenditures and what you can control, simply email me at [email protected] with the subject line “Budget worksheet.”

Wishing you peace and abundance,

Amy Jo

About the author: My mission: I help people make good financial decisions with confidence. My purpose: I help people find peace with money. As President of Lauber Financial Planning, I provide financial advice, guidance and coaching on a fee only basis (no products, no commissions). I run a monthly support group called “I HATE Budgeting (But I Like Having Money)”, offer classes and seminars, speak around the world on the psychological, sociological, spiritual and emotional aspects of personal finance, and am the author of the ground-breaking book, “Living Inspired and Financially Empowered: Aligning Our Spiritual and Material Lives.”

0 Comments