The following blog is by Carl Richards originally published in The New York Times’ Blog.

How many times have you had a conversation when you or the other person said something like:

“I’m so worried about the stock market.”

“I’m so worried about retirement.”

“I’m so worried about the value of my home.”

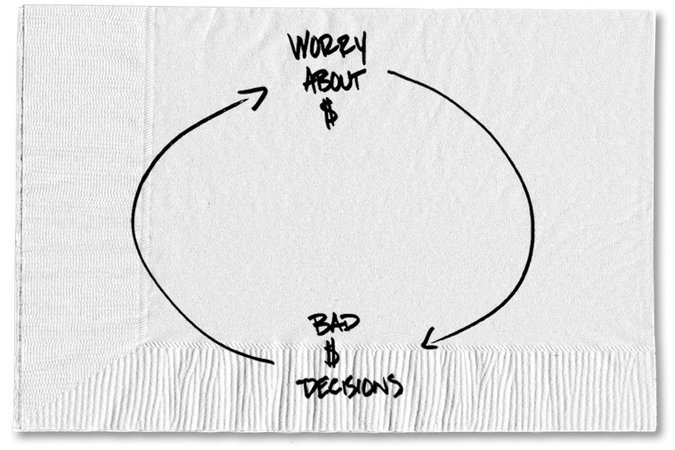

Assuming you have said or heard a derivation of one of these statements, ask yourself a big question: How has that worked out for you? Can you think of a single time when the act of worrying about the stock market, retirement, housing prices or anything else in your financial life has helped?

The act of worrying actually hurts, not helps. Last year, Joseph Engelberg and Christopher A. Parsons published a study that looked at worrying about the stock market specifically. They wondered what impact a drop in the market had on investor psychology, and they found something interesting in hospital admission records.

After looking at nearly three decades of data, Mr. Engelberg and Mr. Parsons, both associate professors of finance at the University of California, San Diego, found that a sharp decline in the stock market was followed by a higher rate of hospitalizations over the next two days. Mental conditions, like anxiety, were particularly prevalent in these situations.

Even if you don’t end up in the emergency room, worrying about money hurts your ability to think clearly about everything else in your life. In a separate study, researchers found that financial worries affect cognitive abilities. Shoppers in New Jersey were asked to consider a $1,500 car repair while solving puzzles like those found on I.Q. tests. Performance worsened for low-income participants, while more affluent people succeeded in the same tasks.

This is another case where simply being aware of the negative impact of worrying is part of the solution. Worrying becomes a habit. It is something we often do without even recognizing that we’re doing it. If we can simply learn to recognize what worrying feels like, with time and practice, we can become more aware of this useless habit and change it by asking ourselves a few simple questions:

What am I really worried about? Is it something in my control?

If it’s in my control, could I resolve my worrying by doing something differently?

If it’s not in my control, do I gain anything by worrying about it?

While it sounds simple, the answers to these questions can reveal not only what’s really bothering you but also a way to help remove some of the worry. I can’t promise that you’ll never worry about anything again. But before you decide to waste time worrying, I suggest you remember what Calvin Coolidge told Herbert Hoover: “Mr. Hoover, if you see 10 troubles coming down the road, you can be sure that nine will run into the ditch before they reach you and you have to battle with only one of them.”

That seems like good advice. It may even help keep you out of the hospital.

About the author: For the last 15 years, Carl Richards has been writing and drawing about the relationship between emotion and money to help make investing easier for the average investor. His first book, “Behavior Gap: Simple Ways to Stop Doing Dumb Things With Money,” was published by Penguin/Portfolio in January 2012. Carl is the director of investor education at BAM Advisor Services. His sketches can be found at behaviorgap.com, and he also contributes to the New York Times Bucks Blog and Morningstar Advisor. You can now buy – “The Behavior Gap” by Carl Richard’s at AMAZON.

0 Comments