Budgeting isn’t a big term for the people who are surviving on tight money. Budgeting is for everyone.

What is budgeting?

Budgeting a process of creating your spending plan. It helps you organise your finances.

Why budgeting is important:

- Secures your financial future

- Helps you plan for short to long term expenses

- Shows you how much money will go out each month and how much you will save

- Helps keep you out of debt and maintain emergency funds

- Most importantly, budgeting helps you achieve your goals. You can know how much you have saved, whether it’s enough for your goals and where you can possibly cut down

Creating a budget is easy. The following steps should get you started:

1. Set Goals:

List your:

- Short term goals

- Medium term goals

- Long term goals

Write down the estimated cost for each of these goals and the targeted date

2. Identify your Incomes and Expenses:

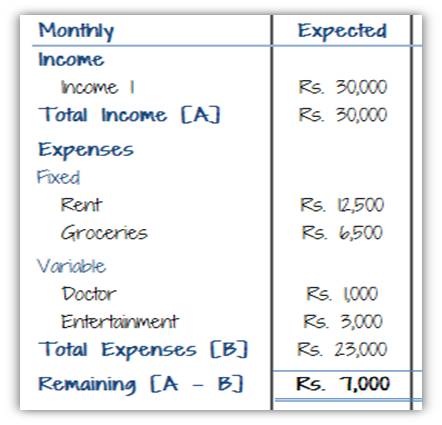

Create a simple worksheet that includes your:

- Monthly income

- Estimated living expenses, fixed and variable; examples: monthly house loans/rent, internet, phone, electricity, groceries, fuel, personal expenses, credit card payments, etc

3. Identify your Needs and Wants:

- Need = something you have to have for survival. Example: food that provides you with the right nutrition

- Want = something you would like to have, but is not necessary. Example: a double chocolate chip sundae

4. Create your Budget:

- Understand billing cycles and expenditure patterns

- Ensure expenses are not more than income

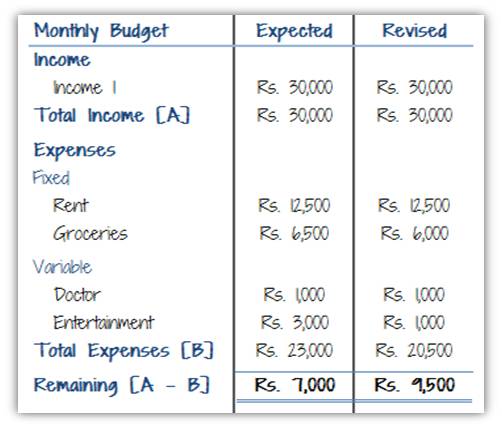

- Make choices with regards to your needs and wants to cut down your expenses to meet your financial goals

- Plan what to do with your savings

- Ensure you have an emergency fund

5. Act:

5. Act:

- You know what needs to paid for and when

- You know how much of your expenses you need to cut down

- You know how much you need to save

It’s now time to put your plan into action!

6. Review:

Monitor, review and re-evaluate your plan to ensure you are on the right track.

You’re now ready to create your first budget today!

0 Comments