What is inflation?

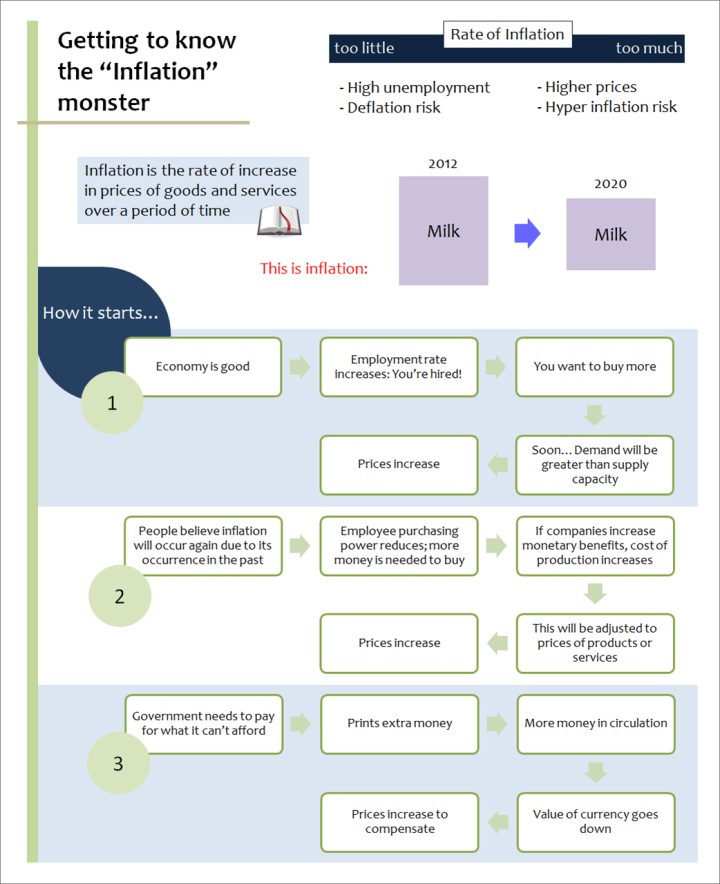

Inflation is the rate at which the prices of goods and services are rising. Purchasing power is lower. When inflation is higher, the currency will buy a smaller amount of the goods or services.

Factors contributing to inflation

- High demand: Demand is growing faster than supply. Therefore, demand cannot be met and prices are increased

- More currency printed: When the government prints more money than can be justified, currency value decreases. Cost of goods from other countries becomes more expensive and prices increase.

- Increased business costs: Increased input costs like wages and imported parts are reflected on the product prices to maintain business profit margins.

- Easy credit: Customers aren’t sensitive to price changes. They are ready to buy expensive products with borrowed money. Businesses take and advantage and continue to increase their product prices seeing the customers’ non-sensitivity to increased prices.

How inflation affects your finances

Inflation becomes a financial burden to everyone. Remember lasts week’s grocery shopping? Food prices had increased and when you had to feed the car fuel tank on the way back home, you reluctantly had to give away more for petrol. How many of us feel that we need a time machine to take us back to those old days where prices wouldn’t hit us on the face, and we wouldn’t have to think about whether something can be foregone due to the higher prices? And it would be better if we could go back and stock up for today!

Inflation can make it difficult to meet ends. It’s worse when your salary does not keep up with the inflation.

In fact when planning for retirement, you need to keep the effects of inflation in mind. If you think in today’s worth, you would need Rs 1 crore to keep you going for 15 years when you retire, you are wrong. You would need to save more than that! You need to adjust for higher living costs. Food, fuel and healthcare will definitely to be more expensive! You need to cope with this reality. Even when saving for emergency funds, inflation needs to be accounted for. What is currently worth 6 months of expenses may become 5 months’ worth after a year.

When preparing for your future, consider protecting yourself from inflation. When making financial calculations, it important to adjust for inflation costs. Diversification of investments is a start! Investing in yourself by increasing your knowledge and skills may help increase your future earning power.

Are you ready for the future now?

0 Comments